With revelations today about HSBC's part in helping the rich avoid (and possibly evade) tax, the blogosphere has become clogged with high-minded moralising over the wrongness and immorality of tax avoidance more generally. In recent times, companies like Starbucks and Amazon have been vilified for 'aggressive' tax avoidance, despite avoiding tax being perfectly legal and within the bounds of the law. The distinction between tax avoidance and tax evasion is important. Recently, the line between the two has become blurred as people have condemned both, often without realising the difference.

Tax evasion is illegal and clearly wrong. There is not any disagreement about this. Companies or individuals found to be breaking laws with regard to their tax liabilities should be made to pay the entire amount originally required (as well as any compensation that may be warranted), and the full extent of the law should be pursued.

Tax avoidance, however, is perfectly legal, and it is here where The Economic View has concerns over the aforementioned recent 'high-minded moralising'. It is also too easy to criticise and condemn companies for avoiding tax, complaining of the wrongness morally of doing so. But, if a company is complying with all laws, then what is the right amount of tax to pay, if not the current amount? What is the moral amount of tax to pay? Much of the discussion around these issues is very generalised and vague about the wrongs of Amazon or Starbucks or whoever paying a certain amount of tax deemed 'too low'. But, if it is within the bounds of the law, then what is wrong? What amount should they pay instead?

As any tax accountant will tell you, there are a million different ways for individuals or companies to manage their tax affairs. Tax liabilities can be structured in an infinite number of different ways, varying in efficiency and the amount of tax paid. Who is to say which of these infinite number of different tax structures is more moral, or 'better' than any other, if they are all legal?

Lastly, while it is easy to condemn companies for tax avoidance, who among us does not avoid tax? The Economic View certainly does not know anybody who voluntarily pays any more tax than is legally required, yet this is not seen as wrong. Many people will buy things in duty free while going on holiday each year, avoiding VAT, yet this is seen as permissible.

While it is all too easy to moralise about the wrongs of tax avoidance and evasion vaguely and generally, specificity is needed as to whether the activity in question is legal or illegal. Clearly, illegal tax evasion is wrong, but what about legal tax avoidance? It is unfair to expect companies, or individuals, to pay anything more than the minimum amount required by law. If we want rich individuals and large multi-national companies to pay more tax, we need to change the laws to force them to do so.

Showing posts with label economics. Show all posts

Showing posts with label economics. Show all posts

Monday, 9 February 2015

Sunday, 8 February 2015

Why Governments Bribe Old People - Public Choice Economics

George Osborne, Chancellor of the Exchequer, today announced that government-backed pensioner bonds, offering interest rates of up to 4%, will be offered for an extra 3 months. These 'granny bonds' have, unsurprisingly, proven extremely popular due to the high interest rate being offered, and 600,000 people have now signed up. This latest offering from the government comes on top of a host of other universal benefits already offered to the old, including the winter fuel allowance, free tv licenses and free bus passes. The current government also introduced the 'triple lock' system for pensions, meaning the state pension will increase by whichever is highest out of inflation, average earnings growth, or 2.5% per year. On top of this, the coalition government has protected spending on the National Health Service (NHS), 'ring fencing' the department on which the old particularly rely, while also announcing this week that the education budget is set to face real terms cuts next parliament. Evidently, pensioners are getting a mightily good deal, particularly in the context of the fiscal austerity of the current parliament. It's no coincidence that the old are getting such a good deal, and it can be explained largely through some good, old-fashioned economics.

The Public Choice school of economics provides valuable insights into the workings of a democracy. It analyses and explains the behaviour of politicians by studying incentives. It argues that, in the political realm as in the economic realm, incentives matter and people respond strongly to the incentives that they face. Politicians aim to maximise their share of the vote; they want to get elected and, after, stay in power. So why would enlarging the benefits offered to pensioners or, some might say, bribing them, achieve this end?

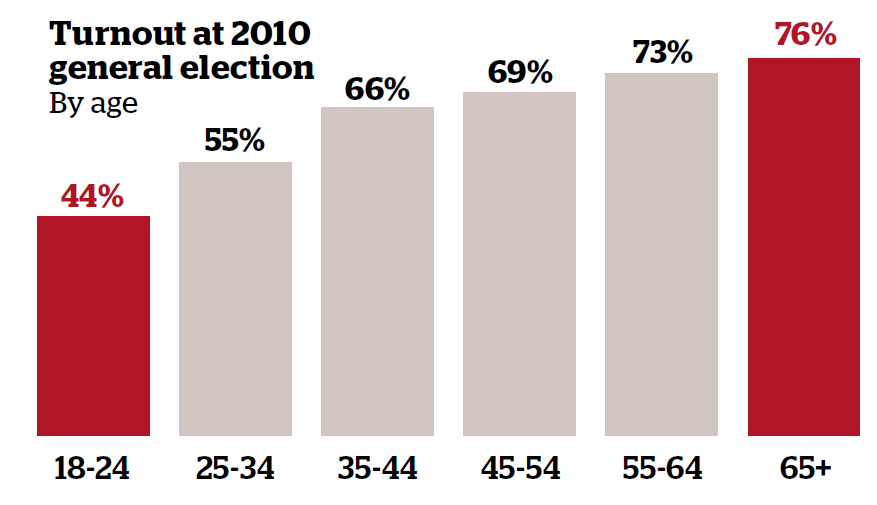

Firstly, pensioners are numerous. Current figures reveal there are 10 million people aged 65 or over living in the UK. The proportion of old people in the UK is growing too. In 1971, 20% of the population was aged 60 or above, but by 2020 this figure is projected to be one third. Old people are not just large in number, but are more likely to vote too. In 2010, 94% of those aged 65 and over had registered to vote, with 76% of these going to the ballet box on election day. Contrastingly, only 55% of people aged 18-24 were registered to vote, with only 44% of registered voters in this age group ultimately doing so. Evidently, the power of the 'grey vote' is enormous and it is not hard to see why UK governments pursue the policies they do towards old people.

Now, this analysis does not, of course, mean that electoral incentives are all that politicians care about, or that all pensioners only vote to maximise their own self-interest. What is does show however, is that, as in much of society and life, many phenomena can be explained by a simple study of incentives and the analytical framework of economics. The economists' toolkit comes in handy once again.

Labels:

bribe,

coalition,

democracy,

economics,

government,

granny bonds,

pensioner bonds,

politics,

public choice,

public choice economics,

public choice school

Subscribe to:

Posts (Atom)